All Categories

Featured

Table of Contents

Prostock-Studio/ GOBankingRates' editorial group is devoted to bringing you honest testimonials and information. We use data-driven methodologies to examine economic product or services - our testimonials and scores are not affected by marketers. You can learn more about our content guidelines and our items and solutions evaluate methodology. Boundless financial has caught the rate of interest of several in the personal financing globe, guaranteeing a course to financial liberty and control.

Infinite financial refers to a monetary technique where a private becomes their very own banker. This principle focuses on the use of entire life insurance policies that build up money value with time. The policyholder can obtain against this money value for numerous financial needs, efficiently loaning money to themselves and paying back the policy on their own terms.

This overfunding speeds up the development of the plan's cash money value. The insurance holder can then borrow versus this cash worth for any type of purpose, from funding a vehicle to purchasing real estate, and afterwards repay the loan according to their very own timetable. Infinite banking supplies several benefits. Below's a consider a few of them. Life insurance loans.

What are the most successful uses of Tax-free Income With Infinite Banking?

It entails utilizing an entire life insurance policy to develop an individual financing system. Its performance depends on numerous factors, consisting of the plan's structure, the insurance business's performance and how well the strategy is handled.

How much time does infinite financial take? Unlimited financial is a long-term method. It can take several years, frequently 5-10 years or more, for the money worth of the policy to expand sufficiently to begin obtaining against it properly. This timeline can vary relying on the policy's terms, the premiums paid and the insurance provider's efficiency.

Who can help me set up Whole Life For Infinite Banking?

Long as costs are current, the insurance holder simply calls the insurance business and requests a financing versus their equity. The insurance provider on the phone will not ask what the car loan will be utilized for, what the income of the debtor (i.e. insurance holder) is, what various other possessions the individual might have to act as collateral, or in what timeframe the individual intends to repay the car loan.

In contrast to label life insurance products, which cover just the beneficiaries of the insurance policy holder in the occasion of their death, whole life insurance coverage covers an individual's entire life. When structured effectively, entire life policies generate a distinct earnings stream that enhances the equity in the plan over time. For more analysis on how this works (and on the pros and cons of entire life vs.

In today's world, globe driven by convenience of benefit, too many also several granted our provided's country founding principles: concepts and flexibility.

What are the most successful uses of Leverage Life Insurance?

Reduced lending interest over plan than the traditional finance items obtain security from the wholesale insurance plan's money or surrender value. It is a concept that permits the insurance holder to take finances on the whole life insurance policy. It should be available when there is a minute financial worry on the person, in which such loans might help them cover the economic load.

Such surrender worth acts as money security for a loan. The policyholder needs to get in touch with the insurance provider to request a loan on the plan. A Whole Life insurance coverage policy can be termed the insurance policy item that supplies defense or covers the individual's life. In case of the feasible death of the person, it provides monetary safety and security to their relative.

The plan might require monthly, quarterly, or annual repayments. It starts when an individual takes up a Whole Life insurance policy plan. Such policies may invest in corporate bonds and government protections. Such plans preserve their worths as a result of their traditional strategy, and such policies never purchase market tools. As a result, Unlimited financial is an idea that enables the insurance holder to occupy finances on the whole life insurance policy plan.

Financial Leverage With Infinite Banking

The money or the abandonment value of the entire life insurance policy works as security whenever taken lendings. Suppose an individual enrolls for a Whole Life insurance coverage policy with a premium-paying regard to 7 years and a plan period of 20 years. The private took the plan when he was 34 years old.

The collateral acquires from the wholesale insurance plan's cash money or surrender worth. These factors on either extreme of the spectrum of realities are reviewed listed below: Limitless financial as a monetary advancement enhances cash money flow or the liquidity account of the insurance holder.

What happens if I stop using Leverage Life Insurance?

In financial dilemmas and challenges, one can make use of such products to avail of lendings, therefore mitigating the trouble. It supplies the least expensive finance expense compared to the traditional finance item. The insurance coverage policy loan can likewise be available when the individual is unemployed or encountering health and wellness issues. The Whole Life insurance policy plan retains its general value, and its performance does not relate to market performance.

Normally, acts well if one entirely relies upon financial institutions themselves. These principles work for those who possess solid monetary cash circulations. On top of that, one have to take just such plans when one is financially well off and can take care of the plans premiums. Unlimited banking is not a fraud, however it is the ideal thing the majority of people can select to improve their financial lives.

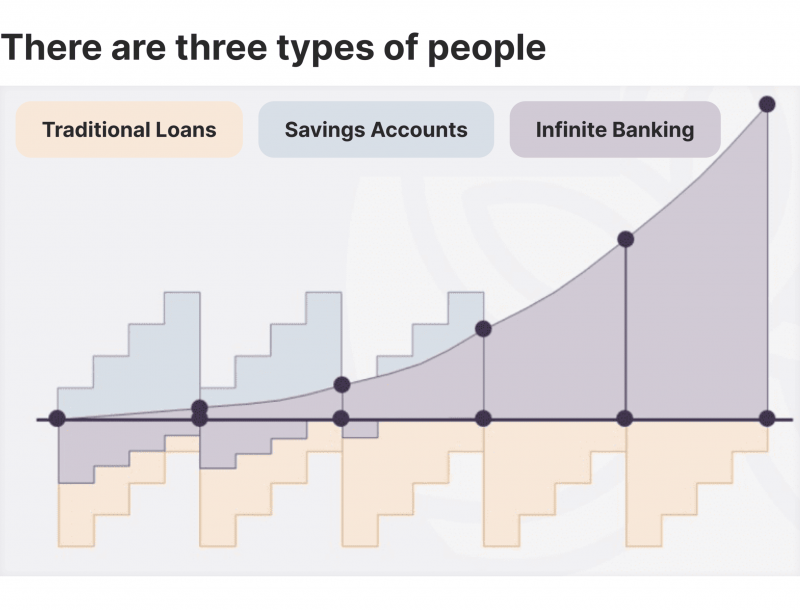

Is Infinite Banking Concept a better option than saving accounts?

When individuals have infinite banking discussed to them for the very first time it looks like a wonderful and safe way to grow wide range - Generational wealth with Infinite Banking. The concept of replacing the hated bank with borrowing from on your own makes so a lot even more feeling. But it does need replacing the "despised" bank for the "despised" insurance policy business.

Of training course insurance policy business and their agents like the principle. They developed the sales pitch to offer even more entire life insurance coverage.

There are no products to get and I will offer you nothing. You maintain all the cash! There are two major monetary catastrophes built into the infinite financial principle. I will subject these flaws as we overcome the math of exactly how boundless financial really works and just how you can do better.

Latest Posts

Infinite Banking Spreadsheet

Become Your Own Bank Today! It's A Strategy That Many Have ...

How To Be Your Own Bank In Just 4 Steps