All Categories

Featured

Table of Contents

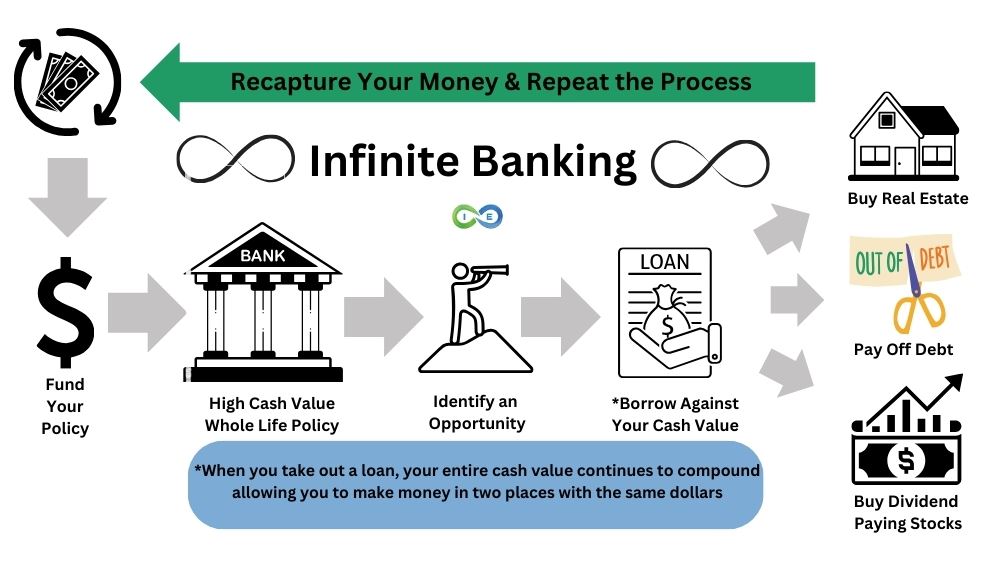

The method has its own benefits, but it also has concerns with high fees, complexity, and more, leading to it being related to as a scam by some. Limitless banking is not the most effective policy if you need just the financial investment element. The unlimited financial concept focuses on using whole life insurance plans as a monetary tool.

A PUAR allows you to "overfund" your insurance coverage right up to line of it becoming a Changed Endowment Contract (MEC). When you use a PUAR, you quickly boost your cash money worth (and your fatality benefit), therefore increasing the power of your "financial institution". Further, the even more cash worth you have, the better your rate of interest and reward settlements from your insurance coverage company will be.

With the increase of TikTok as an information-sharing system, monetary advice and approaches have located a novel way of dispersing. One such method that has been making the rounds is the limitless banking idea, or IBC for short, amassing recommendations from stars like rapper Waka Flocka Fire - Cash value leveraging. Nonetheless, while the approach is presently prominent, its origins trace back to the 1980s when financial expert Nelson Nash presented it to the world.

Can Privatized Banking System protect me in an economic downturn?

Within these plans, the cash money value grows based on a rate established by the insurance provider. When a considerable money value gathers, insurance policy holders can acquire a cash money value loan. These fundings vary from traditional ones, with life insurance policy functioning as security, suggesting one could shed their protection if loaning excessively without ample cash money worth to support the insurance expenses.

And while the attraction of these plans is evident, there are innate restrictions and threats, demanding attentive cash worth monitoring. The strategy's authenticity isn't black and white. For high-net-worth individuals or local business owner, particularly those using methods like company-owned life insurance policy (COLI), the advantages of tax breaks and substance growth can be appealing.

The attraction of boundless banking doesn't negate its difficulties: Expense: The foundational need, a long-term life insurance policy policy, is more expensive than its term equivalents. Eligibility: Not everyone gets whole life insurance policy due to strenuous underwriting processes that can omit those with certain wellness or way of life conditions. Complexity and threat: The intricate nature of IBC, paired with its threats, may prevent lots of, specifically when less complex and less dangerous options are readily available.

Can I use Private Banking Strategies to fund large purchases?

Assigning around 10% of your regular monthly earnings to the plan is just not possible for many individuals. Using life insurance policy as an investment and liquidity resource calls for self-control and monitoring of plan money value. Speak with a financial expert to identify if boundless banking aligns with your concerns. Part of what you review below is merely a reiteration of what has already been said over.

So prior to you get on your own into a circumstance you're not planned for, recognize the adhering to first: Although the principle is typically marketed as such, you're not in fact taking a funding from on your own. If that held true, you would not need to repay it. Instead, you're obtaining from the insurance provider and have to settle it with passion.

Some social networks posts advise making use of cash money value from whole life insurance coverage to pay down charge card financial debt. The idea is that when you settle the funding with interest, the amount will be sent out back to your investments. That's not exactly how it functions. When you pay back the financing, a portion of that interest mosts likely to the insurer.

How do I qualify for Infinite Banking?

For the initial several years, you'll be paying off the commission. This makes it exceptionally tough for your policy to gather worth throughout this time. Unless you can manage to pay a couple of to several hundred bucks for the following decade or more, IBC will not function for you.

Not every person should depend only on themselves for financial protection. Life insurance loans. If you need life insurance policy, right here are some important pointers to consider: Take into consideration term life insurance. These policies provide insurance coverage throughout years with significant monetary obligations, like home loans, trainee finances, or when looking after young kids. Make sure to search for the ideal price.

Can anyone benefit from Cash Value Leveraging?

Imagine never needing to stress over financial institution car loans or high rate of interest once again. What if you could borrow cash on your terms and construct riches at the same time? That's the power of unlimited financial life insurance policy. By leveraging the money value of entire life insurance policy IUL plans, you can expand your wide range and obtain money without depending on typical financial institutions.

There's no set financing term, and you have the flexibility to pick the settlement timetable, which can be as leisurely as paying back the finance at the time of fatality. This adaptability prolongs to the maintenance of the finances, where you can choose interest-only settlements, keeping the financing balance level and manageable.

Can I access my money easily with Borrowing Against Cash Value?

Holding money in an IUL repaired account being attributed rate of interest can often be far better than holding the cash on down payment at a bank.: You've always imagined opening your own pastry shop. You can obtain from your IUL policy to cover the first costs of renting a room, purchasing devices, and employing personnel.

Individual fundings can be gotten from typical banks and cooperative credit union. Below are some bottom lines to think about. Credit score cards can offer a flexible way to obtain cash for extremely short-term durations. Nonetheless, borrowing cash on a bank card is usually extremely pricey with yearly percent prices of passion (APR) often getting to 20% to 30% or even more a year.

Latest Posts

Infinite Banking Spreadsheet

Become Your Own Bank Today! It's A Strategy That Many Have ...

How To Be Your Own Bank In Just 4 Steps